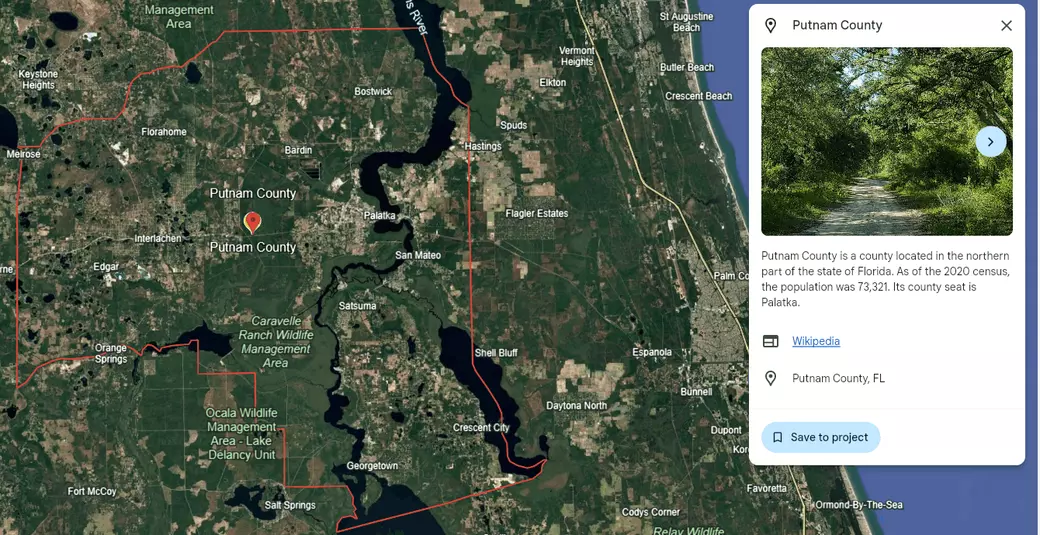

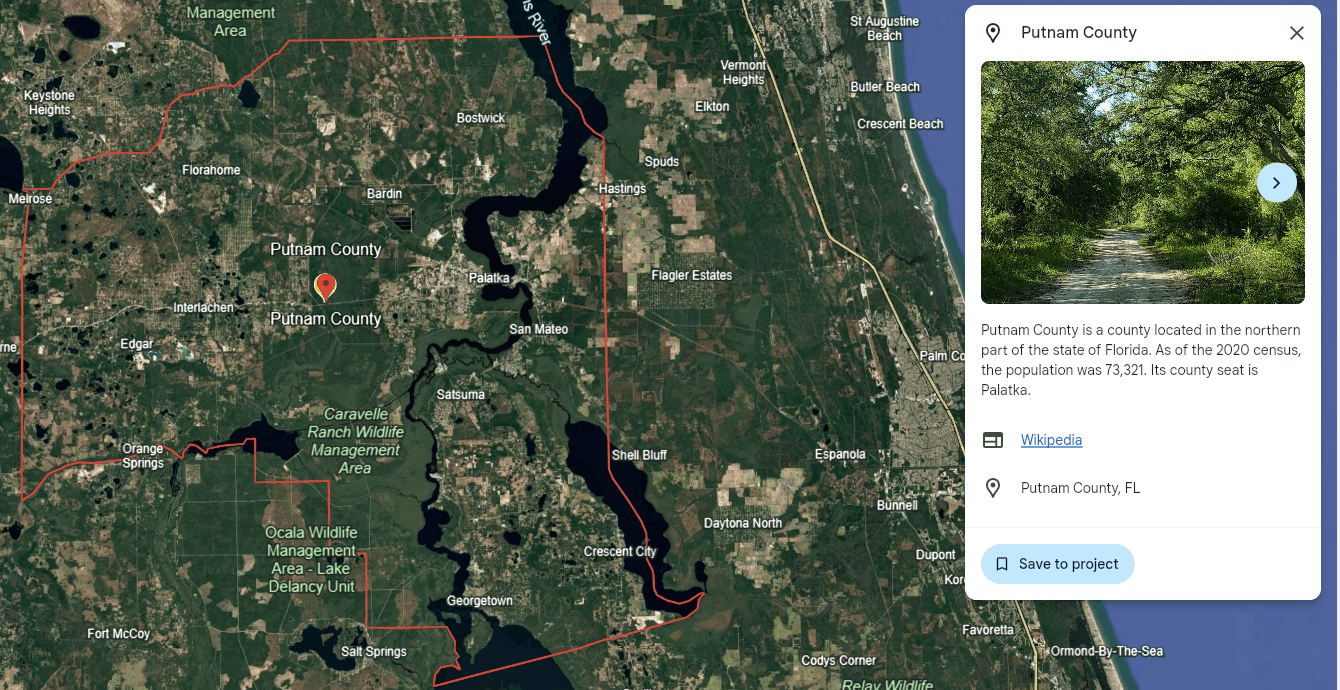

Blog > Homesteader Guide to Putnam County, Florida

Homesteader Guide to Putnam, Florida

Whats allowed, Whats NOT allowed, Tax benefits and more!

AGRICULTURE means the use of land for agricultural purposes, including farming, dairying, pasturage agriculture, silviculture, horticulture, floriculture, viticulture, and animal and poultry husbandry and the necessary accessory uses for packing, treating, or storing of produce.

Buying a home in Agricultural (AG) zoning—especially in Putnam County, Florida—means you’re purchasing a property in a district primarily intended for agricultural uses and rural living.

- Agriculture (General): Low-intensity farming, gardening, livestock raising.-HOBBY/SMALL SCALE less than 5 acres

- Agriculture (Intensive): Operations with high waste or regulatory burdens (e.g., pig farms).-COMMERCIAL over 5 acres

-

Feature < 2 Acres 2–4.99 Acres 5+ Acres Livestock (residential) ✅ Allowed ✅ Allowed ✅ Allowed Accessory structure (no house) ❌ Not without permit ✅ One ≤ 2,500 sq ft allowed ✅ Allowed Intensive agriculture ❌ Requires SUP ❌ Requires SUP ✅ Requires SUP, but eligible Exotic/wild animals (Class I/II) ❌ Requires SUP ❌ Requires SUP ✅ Requires SUP

The AG zoning district is designed to:

Implement the Agriculture Future Land Use classification from the County’s Comprehensive Plan.

Preserve large areas of rural land for farming, forestry, livestock, and low-density housing.

Serve as a “holding zone” in some rural or urban reserve areas until more intense development is appropriate.

Putnam is home to National and State parks, conservation lands and wildlife managment areas.

Recognized as "Bass capital of the World" for the St. John's River and its 88 lakes throughout the county, "Bassmaster Elite Series"comes every year.

Lake Ocklawaha and Smaller lakes are found on the Westside of the Putnam near Interlachen, which directly translates to "Between Lakes" but massive Lake Crescent and Lake George are in the Southeast part of Putnam.

Allowed by Right (No Special Permit Needed):

Single-family homes (including mobile homes).

Site-built homes

Modular homes

Mobile homes -Only allowed in AG zoning (not AE or RE) still subject to building codes.

General agriculture (farming, livestock, non-intensive).

Educational uses.

Recreational uses (resource-based or activity-based like parks, hunting, or fishing—not motorsports)

Artificial ponds (≤ 5 acres).

Religious facilities (under 10,000 sq ft) on roads classified as minor collectors or higher.

Community residential homes with 6 or fewer residents.

Definition: Livestock, Residential shall mean the keeping of equines, cattle, swine, fowl, and/or goat on a residential lot that is five acres or less in size and located in an agricultural zoning district (AG or AE).

Supplemental Regulations

1.The residential livestock shall be kept in a fenced enclosure maintained to restrict the animals from being closer than 10 feet to a property line.

2. If a place of shelter is provided it must be 100 feet or more from a residence of different ownership.

3. The following minimum area requirements shall be maintained: (a) One (1) horse or other equine per acre. (b) (c) (d) One (1) cow or other cattle per acre. Six (6) goats or sheep per acre. Forty (40) chickens or other poultry per acre in AG and AE zoning districts, but only 1 rooster (male). (e) All swine/pigs shall constitute an intense agricultural operation and be required to obtain a Special Use Permit as outlined in Article 12, Section 12.12 of the Land Development Code. One (1) pig/swine is allowed temporarily without a Special Use Permit if the animal is for a 4H/FFA project connected to the Putnam County Fair. Length of stay of said animal shall be from birth to the end of the fair. Said animal shall be removed within 30 days of the end of the Fair.

4. As used herein, an “acre” means one acre of undeveloped, useable land area; and does not include the area serving the primary residential structure. The area requirements are per animal, i.e., a single acre may not support both a horse and a cow, but only one horse or one cow.

Uses that Require a Special Use Permit

You’ll need approval for:

Intensive agriculture (e.g., feedlots, high-intensity dairies, poultry farms).

Commercial agriculture-related uses (e.g., sawmills, livestock auctions, riding academies).

Essential public services (e.g., water/sewer plants).

Emergency services (fire, EMS, sheriff).

Larger or more impactful uses like:

-

- Bed & breakfasts

- Group homes (7+ residents)

- Religious facilities ≥ 10,000 sq ft

- Kennels

- Borrow pits (> 1/8 acre)

- Communication towers

- Cemeteries

- Shooting ranges, golf courses, or airstrips

- Wildlife keeping or exotic animals

- Landfills for C&D or clearing debris

- Septage land application

- Bed & breakfasts

WILD PETS

These are categories under FWC (Florida Wildlife Code):

Class I – Prohibited for Personal Possession

Includes:

Bears

Big cats (lions, tigers)

Crocodiles, chimpanzees

Typically prohibited unless for research, education, or exhibition.

Class II – Requires Permit, High Regulation

Includes:

Wolves

Lynxes

Macaques

Alligators (4+ ft)

Some large reptiles

Permits from FWC are required, and applicants must meet extensive caging, training, and facility requirements.

Summary: What You Need to Keep Class I or II Wildlife in Putnam

| Requirement | Details |

|---|---|

| Zoning Compliance | Must be in a zoning district that allows wildlife pets with a Special Use Permit |

| SUP Application | Apply through the Putnam County Planning & Zoning Department |

| FWC Permit | You’ll need a valid Class I or II wildlife permit from the Florida Fish and Wildlife Conservation Commission |

| Property Size & Facilities | You may be required to show minimum acreage, fencing, and habitat standards during SUP review |

| Public Notice | Special Use Permits often involve public hearings and neighbor notification |

Wildlife Zoning Notes from the Putnam Code:

AG (Agricultural): SUP required for “Wildlife Pets”

AE & RE (Agricultural/Residential Estate): Same — cannot keep without permit

Residential-2 (R-2): Allows Wildlife Pets only with a SUP

Residential-3 (R-3): Same — requires SUP

Lot Size, Setbacks, and Development Rules

AG land is often large acreage (2+ acres recommended for outbuildings).

Accessory buildings >150 sq ft must follow standard setbacks.

Accessory buildings ≤150 sq ft may be 3 ft from rear/side lot lines (except waterfronts).

Buildings must comply with Florida Building Code.

Waterfront and wetland development has extra setbacks and limits.

Development Permits & Timing

In AG zoning, you may build an accessory structure before the main residence if:

-

- The lot is ≥ 5 acres, or a bona fide farm.

- The lot is 2–5 acres: you’re allowed one accessory building ≤ 2,500 sq ft with permits.

- < 2 acres: must have the main house or a permit for it already.

- The lot is ≥ 5 acres, or a bona fide farm.

Regulatory Bodies

Putnam County Planning and Zoning Department oversees zoning compliance, permitting, and interpretation.

Florida Department of Environmental Protection (DEP) may be involved if wetlands, wastewater, or surface water is impacted.

Tax Benefits (Florida Statutes §196.031, §193.155)

- The Homestead Exemption reduces the assessed taxable value of your primary residence by:

- $25,000 for all property taxes (school and non-school)

An additional $25,000 for non-school taxes if assessed value is over $50,000

- Once you get the homestead exemption, annual increases in assessed value are capped at 3% or the CPI, whichever is less.

This helps protect long-term owners from tax spikes as property values rise.

Asset Protection (Florida Constitution Article X, Section 4)

Your primary residence is protected from most creditors.

this includes protection against:

Civil judgments

Bankruptcy creditors

Credit card debt

Exceptions: The home can be foreclosed for:

Mortgages

Property taxes

Mechanic's liens (unpaid contractors)

Size of the property protected:

Inside a municipality (city limits): Up to ½ acre

Outside a municipality (unincorporated): Up to 160 contiguous acres

Limits and Pitfalls

You can only have one Florida homestead exemption per person/family.

Renting out the property for extended periods (usually more than 30 days for 2 consecutive years) may disqualify your exemption.

Homestead protections do not apply to:

-

- Business debts

- IRS tax liens

- Business debts

HOA liens (in some cases)

- Homestead status provides automatic inheritance rights:

- Spouses cannot be disinherited from homestead property.

- Minor children must be considered.

- Homestead property is not subject to creditors’ claims in probate, except for mortgages or tax liens.

- You can claim homestead exemption on AG-zoned land as long as:

- You reside on the property.

- The portion of land used for residential living is clearly identified.

The remainder of the land may qualify for agricultural exemption (greenbelt classification) if used for bona fide farming.

Additional Related Benefits

Greenbelt + Homestead

“Greenbelt.” Agricultural classification is not technically a property tax exemption, but it can help to lower the overall tax you pay on your property- my interpretation is this is for bona fide farming operations and used to keep your taxes low if growth around you occurs.

-

You can stack benefits: get a homestead exemption on the portion you live on, and a greenbelt classification on the rest.

Timber Exemption

-

Long-term silviculture (tree farming) operations may qualify.

-

Needs a forest management plan, timber cruising, or reforestation record.

Beekeeping (Apiary)

-

Must have a state-registered apiary.

-

Qualifies if part of a commercial honey operation.

Agricultural Sales Tax Exemptions

Under Florida Statute §212.08(5):

-

Farmers can apply for a Florida Agricultural Sales Tax Exemption Certificate.

-

Allows tax-free purchases on:

-

Fertilizers

-

Feed

-

Fencing

-

Equipment and parts

-

Irrigation

-

Farm vehicles and trailers

-

How to apply:

Apply through the Florida Department of Revenue (DR-13 Form).

Livestock and Equipment Exemptions

-

Livestock (cows, goats, sheep, pigs, etc.) raised for commercial sale can qualify the land for ag classification.

-

Ag equipment may be exempt from personal property tax if used solely for production and not leased.

Reasons Agricultural Classification Might Be Denied or Lost

-

Land isn’t actively used or is used for hobby farming.

-

Not enough income or activity to justify “commercial intent.”

-

The land has been idle, cleared for development, or not managed.

-

Filing deadlines missed (March 1).

-

Insufficient documentation or change of use.

Where to Apply

-

Your county’s property appraiser handles the greenbelt/agricultural classification.

-

Most have specific application forms online (Putnam County has one).

-

You must re-verify use periodically or upon request.

Relevant Statutes & Resources

| Law | Topic |

|---|---|

| §193.461, F.S. | Agricultural Classification (Greenbelt Law) |

| §212.08(5), F.S. | Sales tax exemptions for ag materials |

| §193.451, F.S. | Classification of livestock, poultry, etc. |

| Florida Administrative Code 12D-5 | Ag use assessment guidelines |